So you are interested in buying a property. Congratulations! We know how exciting it is to invest in your future. Whether you are looking to buy a place to live, a rental property, or something for a family member, we would love the opportunity to be in your corner. We pride ourselves on finding THE BEST place for your needs and being an advocate for you during the process.

Why The Enloe Group

We know you have lots of choices on who to work with in your real estate transaction, but we whole heartedly believe you won’t find anyone who will work harder, treat you better, or be more committed to your real estate success than us. Here are a few of our top reasons why choosing The Enloe Group is a solid decision.

- We know the market: We are active realtors doing numerous transactions a year, which means we always have current firsthand experience about what the market is doing and how best to negotiate for you.

- We have a stellar track record: Even in a competitive market with complicated search criteria we are known for getting our clients’ their dream homes. Online listings are a great first step but don’t always show the full picture. When you’ve walked through as many homes as we have, you develop a unique way of viewing listing photos to really understand what the house has in terms of layout, finish quality, and space. We’ve had several clients comment “I see why you didn’t recommend this one for me” when they asked to see a home we didn’t flag as meeting their search criteria, or “You were right, this is THE one” when we told them we’d found a winner that just listed. Let us do the hard work of filtering through possible homes and find you the best option.

- We never stop working for you: It’s our goal to make this process easy and enjoyable for you. There are a lot of moving parts in a home transaction and it’s our job to track all the details and alert you of upcoming steps, key dates, etc. Rest assured we’ve got you covered!

- We’re in the know: We can take you to see any home listed for sale, whether it is listed with our brokerage or another in the area. We belong to the region’s professional listing service, which gives us access to them all. That way we can really show you what all is out there.

- We are here to help: From house hunting to making an offer, contract negotiations (repair addendum and appraisal), and closing. Our experience in closing several transactions a month, allows us to advise you on the process and better negotiate by citing recent examples and keeping a pulse on each of our service areas.

How to Get Started

So now that you are ready to consider buying a home, what’s next?

- Let’s meet and learn more about your property needs and wants. We will also go over more details about the home buying process and answer any questions you have

- Meet with a lender. They can answer any questions you have about what amount of mortgage you qualify for and help you establish what monthly payment you are comfortable with. Once you know that, we can begin the search for your perfect place. If you need help finding a lender, let us know and we’ll connect you with trusted lenders who’ve successfully worked with our clients.

- We will set up an RMLS email search for you based on your property needs, wants, location preference, and budget allotment and begin the search.

What is the process?

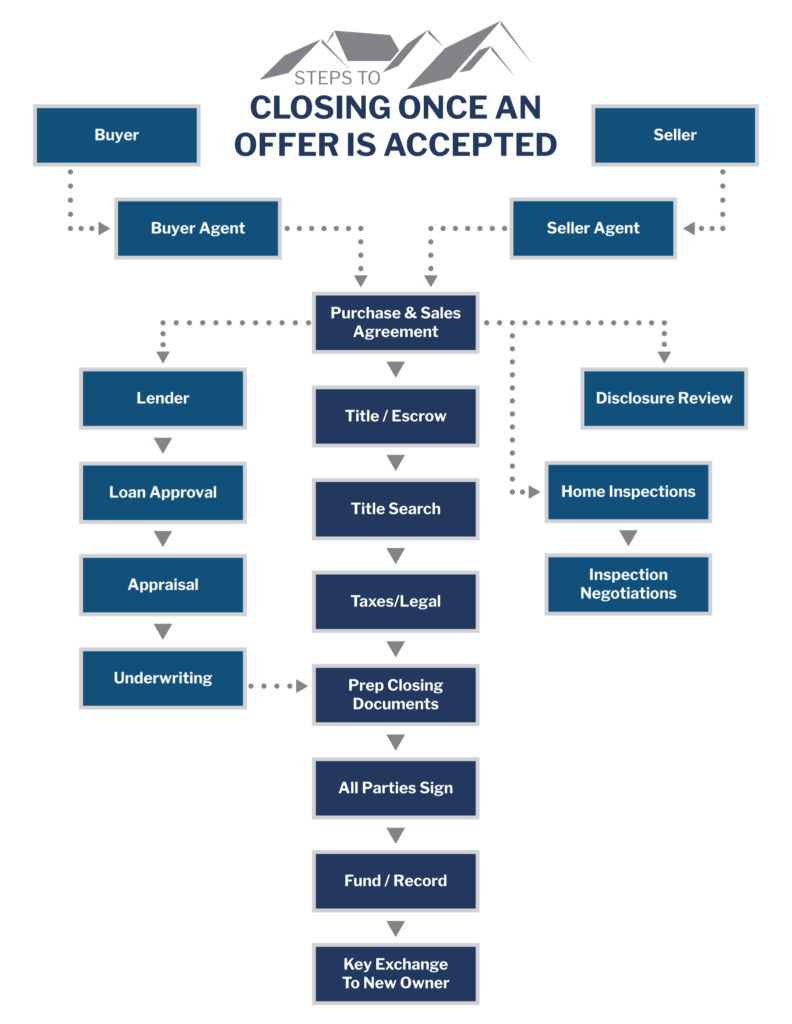

Are you ready for the details? Great! We love details too. Below is a chart we’ve put together on the home buying transaction process.

Transaction Basics

Let’s chat through some transaction basics as a quick review on how buying a home or property works. We will get into more details once we meet, but to help you get started here are some things you’ll want to know more about:

- The contract – The contract documents we use are those recommended for use in the State of Oregon by the Oregon Realtors Association. They are standard and frequently used for real estate transactions. When we get started with your search we will be sure to walk you through the documents and give you plenty of time to review.

- Making an offer – When you find a house or property you are interested in buying, we will help you make an offer to purchase it. We will complete what is called a “comparative market analysis” or CMA to help you understand what people have recently paid for similar houses/properties in the area. This helps us to determine a reasonable market value for the property you’ve selected. We will work with you, provide guidance, and help you establish what you’d like to offer. We also like to reach out ahead of time to the seller’s listing agent and let them know we are working on an offer. This often helps us learn more about the seller’s situation so we can help you make the most competitive offer. Once the offer is presented, the sellers can either choose to accept, reject, or counter your offer.

- Earnest Money – The earnest money is a set of funds that you provide once your offer is accepted. It goes towards your down payment and is provided to the escrow company. The escrow company (or title company) is a neutral third party that will be in charge of the transferring the funds between the two parties (buyer and seller) in line with the contract agreement.

- Home inspection – a home inspection is one you (the buyer) have completed on the house you are buying. You pick the inspector (we can provide a list of names if you’d like) and they take a look at different aspects of the house. There are lots of home inspection options and we can help you pick which are right for you and make sense for the home and property you are buying. Once you have those results, we prepare what is called the “repair addendum”, which is where we ask the seller to either repair or provide funds for you to repair items you’ve identified as important from the inspection report. As your agents, we will help you to negotiate with the sellers to get you the best deal possible. Please note: the home inspections are an out of pocket expense you’ll need to be able to pay for as part of the transaction.

- Home appraisal – The home appraisal is where the bank that is funding your mortgage sends a third party into to review the value of the home. They help the bank feel comfortable that the house/property is worth the amount you are buying/taking out a loan for. This is an out of pocket expense you’ll be asked to pay for as part of your transaction.

- Closing – Closing represents the part of the transaction where the mortgage company sends funds to the seller, the house title is recorded in your name, and it officially becomes yours! We love this part because we get to hand you the keys to your new place.

A Partner for life

After your transaction is complete, we aren’t going anywhere! We want to be an on-going resource for you. We are happy to provide the following:

- Recommendations for contractors and repair service providers

- Annual comparative market analysis to tell you what homes like yours are currently selling for so you know what your investment is doing

- Provide property comps for refinancing, meetings with your financial advisors, etc.

- Got a question? We are happy to help! Let’s grab coffee or have a quick chat to catch up. We are here to help.